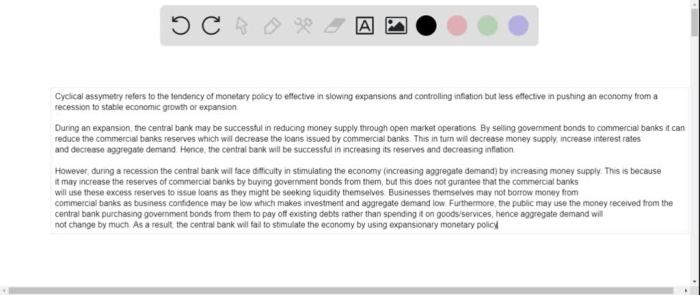

The problem of cyclical asymmetry refers to the idea that certain systems or processes exhibit a tendency to fluctuate or oscillate in a non-symmetrical manner. This asymmetry can lead to imbalances, instabilities, and unintended outcomes, making it a crucial topic for study and analysis.

Cyclical asymmetry arises due to various underlying factors, including positive and negative feedback loops. These feedback mechanisms can amplify or dampen fluctuations, leading to different types of asymmetry. Understanding the causes and mechanisms of cyclical asymmetry is essential for developing effective mitigation strategies.

The Problem of Cyclical Asymmetry

Cyclical asymmetry refers to the phenomenon where a system exhibits different behaviors during its positive and negative phases of a cycle. This asymmetry can lead to imbalances, instabilities, and unintended outcomes.

Definition and Explanation

Cyclical asymmetry occurs when the positive and negative phases of a cycle have different amplitudes, durations, or shapes. For example, in an economic cycle, the period of expansion may be longer and stronger than the period of recession. This asymmetry can lead to imbalances, such as high levels of debt during the expansionary phase and high levels of unemployment during the recessionary phase.

Causes and Mechanisms, The problem of cyclical asymmetry refers to the idea that

Cyclical asymmetry can be caused by a variety of factors, including:*

-*Positive feedback loops

These loops amplify the positive phase of a cycle, making it more intense and prolonged. For example, in an economic cycle, rising asset prices can lead to increased investment, which further drives up asset prices.

-

-*Negative feedback loops

These loops dampen the negative phase of a cycle, making it less severe and shorter. For example, in an economic cycle, falling asset prices can lead to decreased investment, which further drives down asset prices.

-*Structural differences

The structure of a system can also contribute to cyclical asymmetry. For example, a system with a high level of debt may be more vulnerable to a recession than a system with a low level of debt.

Consequences and Implications

Cyclical asymmetry can have a number of negative consequences, including:*

-*Imbalances

Asymmetry can lead to imbalances, such as high levels of debt or unemployment.

-

-*Instabilities

Asymmetry can make a system more unstable, increasing the risk of a crisis.

-*Unintended outcomes

Asymmetry can lead to unintended outcomes, such as a recession that is more severe than expected.

Methods for Analysis

There are a number of different methods for analyzing cyclical asymmetry. These methods include:*

-*Quantitative techniques

These techniques use statistical methods to measure the amplitude, duration, and shape of cycles.

-*Qualitative techniques

These techniques use non-statistical methods to identify and describe the factors that contribute to cyclical asymmetry.

Mitigation and Prevention

There are a number of strategies that can be used to mitigate or prevent cyclical asymmetry. These strategies include:*

-*Feedback mechanisms

Feedback mechanisms can be used to dampen the positive phase of a cycle and amplify the negative phase. This can help to reduce asymmetry.

-*System design

The design of a system can be used to reduce the risk of cyclical asymmetry. For example, a system with a high level of debt can be designed to be more resilient to a recession.

FAQ Insights: The Problem Of Cyclical Asymmetry Refers To The Idea That

What is the definition of cyclical asymmetry?

Cyclical asymmetry refers to the non-symmetrical fluctuation or oscillation of a system or process.

What are the potential consequences of cyclical asymmetry?

Cyclical asymmetry can lead to imbalances, instabilities, and unintended outcomes, affecting the stability and performance of systems.